In this article, we will show you which PCI-DSS requirements you should be aware of and how you can implement them to securely protect payment data and build long-term customer loyalty. You'll find out what steps you need to take now to be prepared for the new requirements and make your store future-proof.

What is PCI-DSS?

Secure payment processing: Protecting sensitive credit card data is essential for merchants and payment service providers | Source: Canva

The Payment Card Industry Data Security Standard (PCI-DSS) is an international security standard developed by leading credit card companies such as Visa, Mastercard and American Express. The aim is to protect sensitive payment data from misuse and ensure secure transactions. Since 2006, it has provided online merchants with clear measures to prevent data leaks and strengthen the trust of their customers.

Why is PCI-DSS important for online merchants?

Merchants that are PCI-DSS compliant fulfill essential security requirements needed to accept credit card payments. This strengthens customer confidence, reduces financial risks and helps to avoid data breaches. Proactive measures such as the encryption of payment information and regular security checks not only increase data security, but also improve the merchant's reputation.

Studies such as the Verizon Payment Security Report show that PCI-DSS compliant merchants are significantly less affected by security incidents. A solid security foundation reduces vulnerabilities and minimizes financial risks.

Data security in online commerce | Source: Canva

New requirements and changes in PCI-DSS 4.0

From 01.04.2025, the Future-Dated Requirements (FDR) for PCI-DSS 4.0 will come into force. They contain more precise security specifications that enable merchants to adapt their security measures to the latest standards. The most important changes include:

Why are these changes important?

Version 4.0 of PCI-DSS takes into account the increasing complexity and frequency of cyber attacks in e-commerce and specifically strengthens the security requirements. Particularly important are the requirements for multi-factor authentication and dynamic security monitoring, which ensure that only authorized access to sensitive data takes place.

Another key point is the implementation of Content Security Policy (CSP) and the regular checking of all scripts used on the payment page to prevent manipulation and unauthorized changes.

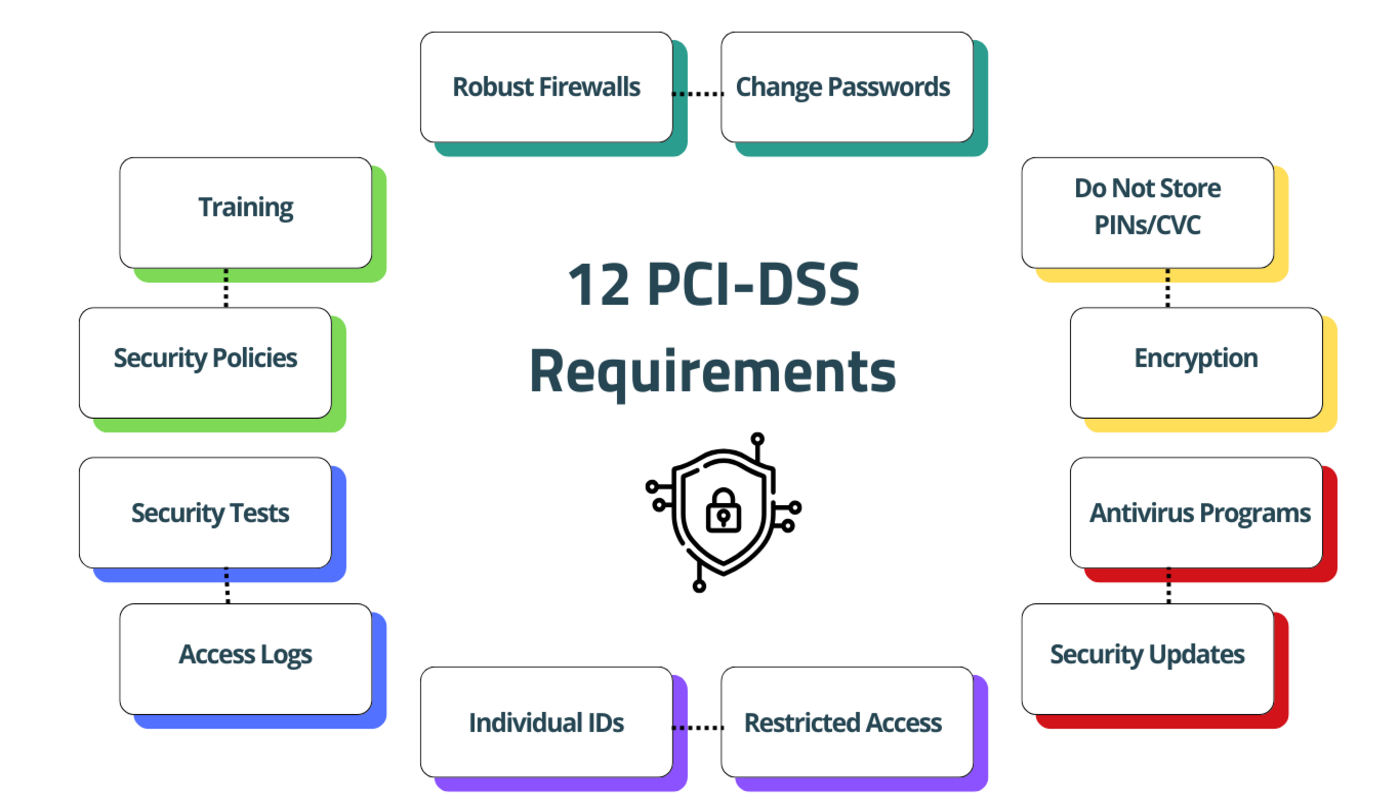

The 12 PCI-DSS requirements

12 PCI-DSS requirements | Source: maxcluster

12 PCI-DSS requirements | Source: maxcluster

Do you want to make your store more secure and strengthen your customers' trust? Then you should familiarize yourself with the 12 PCI-DSS requirements, which are divided into six overarching goals:

Secure networks with firewalls and regular updates

- Implement a robust firewall and keep it up to date.

- Replace default passwords and factory settings immediately after installation.

Protect sensitive data with encryption

- Do not store authentication data such as PINs or CVC numbers.

- Use advanced encryption technologies to secure sensitive information during transmission.

Vulnerability management with clear priorities

- Use reliable antivirus and antimalware programs and update them regularly.

- Install security updates promptly to quickly fix known vulnerabilities and prevent attacks.

Implement strong access controls

- Restrict access to payment data to only essential employees.

- Ensure that each person with access has a unique user ID.

Monitoring and regular testing

- Record all access to card data in logs that are regularly reviewed.

- Conduct vulnerability scans and penetration tests to identify and close security gaps at an early stage.

Clear security guidelines and employee training

- Create comprehensive, easy-to-understand security guidelines that all employees know and follow.

- Conduct regular training so that the entire team recognizes security risks at an early stage and responds appropriately.

Security requirements for payment pages in e-commerce

Secure online shopping | Source: Canva

Version 4.0 of PCI-DSS introduces precise specifications specifically for payment sites to prevent manipulation and protect sensitive data. The most important measures include:

Why is this important?

A manipulated script can put your payment data at risk. Even a small mistake or an unauthorized file is enough to give attackers access to sensitive information. Consistent security measures minimize these risks and strengthen your customers' trust in your store.

Advantages of PCI-DSS compliance

Why is PCI-DSS so important? It's not just about compliance, but above all about tangible benefits for your online store. PCI-DSS helps you to better protect your data, reduce costs and strengthen your customers' trust in the long term. The most important benefits at a glance:

Improved security

PCI-DSS compliant merchants are proven to experience fewer security incidents. Studies such as the Verizon Payment Security Report show that these merchants have significantly fewer data breaches than their non-compliant competitors. A solid security foundation reduces vulnerabilities and protects against cyberattacks.

Cost savings

Security incidents can result in huge costs - not only in terms of repairing damage, but also in potential penalties to acquirers (banks or financial institutions responsible for processing credit card payments on behalf of a merchant) or banks, as well as loss of customer confidence. Furthermore, the merchant incurs additional costs if it can be proven that it is responsible for the loss of credit card data. These include the issuing of new credit cards and potential compensation payments to affected end customers if fraudsters have made purchases with the compromised cards. According to the IBM Cost of a Data Breach Report, the cost of dealing with a single data breach often far exceeds the investment in a PCI-DSS compliant security infrastructure.

Greater customer confidence

Customers increasingly value secure payment solutions and prefer merchants who are credible and trustworthy. A clearly recognizable PCI-DSS notice on your website conveys security and increases customers' willingness to shop with you again and again.

More efficient processes

Regular audits and vulnerability scans help you to identify and rectify security problems at an early stage. This reduces downtime and ensures smooth day-to-day operations.

Long-term reputation

PCI-DSS compliant merchants enjoy a better reputation with business partners. A proven security strategy signals reliability and opens up long-term opportunities for new collaborations and market relationships.

Challenges during implementation

Implementation challenges: strategies for successful implementation | Source: Canva

Implementing PCI-DSS standards can seem complex at first, but with clearly defined steps, the process becomes much simpler. Many merchants face similar challenges, such as:

- Technical adjustments: Existing systems need to be adapted to meet the high PCI-DSS security requirements. This includes the use of modern firewalls, regular system updates and the introduction of strong encryption technologies.

- Cost: PCI-DSS compliance can seem costly at first, especially for smaller companies. However, in the long run, these investments pay off as they significantly reduce the risk of costly security incidents and legal issues.

- Technical expertise: Many merchants lack the necessary technical knowledge to reliably identify and close security gaps. This is where experienced consultants and managed hosting providers who specialize in PCI-DSS can provide valuable support.

- Proven approaches: By working with experts who can efficiently implement both technical and organizational measures, companies can eliminate security risks at an early stage. The result: a secure infrastructure and sustainable cost savings.

Step-by-step guide for retailers

Step-by-step guide: How to successfully implement the PCI-DSS standard | Source: Canva

Implementing the PCI-DSS standards may seem complex at first, but with a clear strategy, the process becomes manageable. This step-by-step guide will help you to systematically fulfill the requirements and make your store more secure:

As-is analysis

Start with a comprehensive inventory of your current IT infrastructure. Document which measures you have already implemented and identify weak points. For example: Check whether your existing firewalls and encryption technologies comply with PCI-DSS standards and record which areas require updating.

Plan measures

Create a detailed schedule and prioritize the most urgent measures. Clarify which resources - such as IT staff or external consultants - are required and set clear milestones to make progress measurable. For example: “Update firewall configurations by the end of the quarter and establish regular security updates.”

Implement technical changes

Upgrade your IT systems by using modern firewalls, encrypting all payment data transfers and closing unnecessary ports. Always keep your software up to date and rely on proven security standards. Remember: A well-configured firewall and strong encryption mechanisms form the foundation of your PCI-DSS compliance.

Conduct employee training

Make your team aware of the new security guidelines. Regular employee training not only ensures a better understanding, but also reduces the risk of human error. Example: Show how to recognize phishing attempts and how to manage access rights correctly.

Audit and certification

Since PCI-DSS 4.0, quarterly ASV scans are mandatory. Some payment service providers are already enforcing this, while others are still following suit. Schedule regular vulnerability scans and penetration tests to identify security gaps at an early stage and have your compliance with the standards audited by a Qualified Security Assessor (QSA). With an official certification, you underline to customers and partners that you take the protection of their data seriously.

maxcluster: Support on the way to PCI-DSS compliance

Compliance with PCI-DSS standards is a crucial step for many online merchants to ensure the protection of sensitive data and meet payment security requirements. Nevertheless, implementation can be challenging. Regular checks, continuous security updates and comprehensive protection measures require time, expertise and resources. This is where maxcluster comes in and supports you in making your e-commerce infrastructure more secure.

Our approach for a secure infrastructure

Secure IT infrastructure: stability and protection for payments and customer data | Source: Canva

We value proven technologies and clear security guidelines in order to create a stable foundation for the PCI-DSS standard. We offer solutions that make it easier for merchants to meet data and payment security requirements.

Reliable server base

Our servers use continuously updated LTS versions of Ubuntu to ensure a high level of stability and security. If you want to know which Ubuntu version or which package versions are installed on your instance, you can find detailed instructions in our Knowledge Base: Determine installed Ubuntu version or package version.

Regular security updates

Our infrastructure is provided with monthly security updates. This enables us to fix known vulnerabilities promptly and ensure a stable operating environment. Customers can see these updates in the Managed Center. You can find more information in the knowledge base article linked above.

Individually customizable encryption

In the maxcluster Managed Center, you can define which TLS versions should be used in your environment. We always recommend the latest versions to meet the highest security requirements.

Network security and protection against threats

By using firewalls, optimized network configurations and continuous monitoring, we ensure that only authorized access is possible and that sensitive data remains protected.

Support for security checks

Regular checks, such as ASV scans, are an important part of the PCI-DSS requirements. We ensure that you receive support in carrying out and evaluating these scans. You can find more information on ASV scans, false positives and the corresponding solutions in our knowledge base.

Conclusion

PCI-DSS is not just a security standard, but a fundamental requirement for long-term success in e-commerce. Compliance with these guidelines protects sensitive customer data, protects your company from legal and financial risks and strengthens the trust of your customers.

At maxcluster, we know how important a reliable infrastructure and secure payment pages are. With our experience in managed hosting and our focus on efficient security solutions, we support you in implementing essential PCI-DSS requirements. So you can concentrate on your core business while we help you overcome technical hurdles.

When was the last time you checked your store's PCI-DSS compliance? Now is the perfect time to take action. Contact us - we'll help you make your store secure and future-proof.

Additional materials

Checklist: PCI-DSS compliance

Use this checklist to ensure that your online store complies with PCI-DSS standards:

Use this checklist to ensure that your online store complies with PCI-DSS standards:

- Firewall: Install secure firewall and update regularly.

- Passwords: Replace default passwords with strong, unique passwords.

- Encryption: Encrypt payment data during transmission and storage.

- Vulnerability scans: Perform regular vulnerability scans and penetration tests.

- Security guidelines: Document clear guidelines and train employees.

- Access rights: Restrict and regularly review access to sensitive data.

- Updates: Update operating systems and software regularly.

- Logging: Record and monitor all activities involving credit card data.

- Content Security Policy (CSP): Allow only authorized scripts and check regularly.

EXTRA webinar recording, implementation tips and expert knowledge

More details on the new requirements and specific implementation tips are explained in maxcluster's webinar. Torben Höhn (Director Business Unit Magento) and Maximilian Fickers (Head of Development Magento) from basecom explain what you need to consider as a store operator and how you can effectively implement the new PCI-DSS 4.0 requirements.

Watch the webinar recording and find out how you can easily implement the new security standards: PCI-DSS 4.0 - What store operators need to consider

Links to additional resources

- Official PCI-DSS website

- E-commerce Security Guide

- Step-by-step guide to PCI-DSS certification

- PCI Merchantcenter

FAQ

- Who is affected by the PCI-DSS?

The Payment Card Industry Data Security Standard (PCI-DSS) applies to all organizations, regardless of size or location, that process, store or transmit payment information. This includes retailers, e-commerce sites, payment service providers and even third parties who handle payment data on behalf of others. - What happens if I do not comply with PCI-DSS?

Non-compliance can have serious consequences: Contractual penalties by the acquirer (bank or financial institution responsible for processing credit card payments on behalf of a merchant) or payment service provider, increased transaction fees and even termination of acceptance contracts. In addition, data breaches can result in costs for card replacement, fraud cases and forensic investigations. In the worst case, a block on future acceptance contracts is possible. - Do I also have to comply with PCI-DSS if I use a payment service provider?

Yes, even if your payment service provider is certified, you as a merchant are responsible for the security of your store. - How often do I have to renew the PCI certification?

The Self-Assessment Questionnaire (SAQ) must be completed once a year to ensure continued compliance. In addition, ASV scans are required quarterly to identify and address security vulnerabilities early. - What type of data is covered by the PCI-DSS?

The PCI-DSS regulates the protection of cardholder data and confidential authentication data. Cardholder data includes the Primary Account Number (PAN), cardholder name, expiration date and service code. Confidential authentication data includes full track data (e.g. from magnetic strips or chips), CAV2/CVC2/CVV2/CID as well as PINs and PIN blocks.